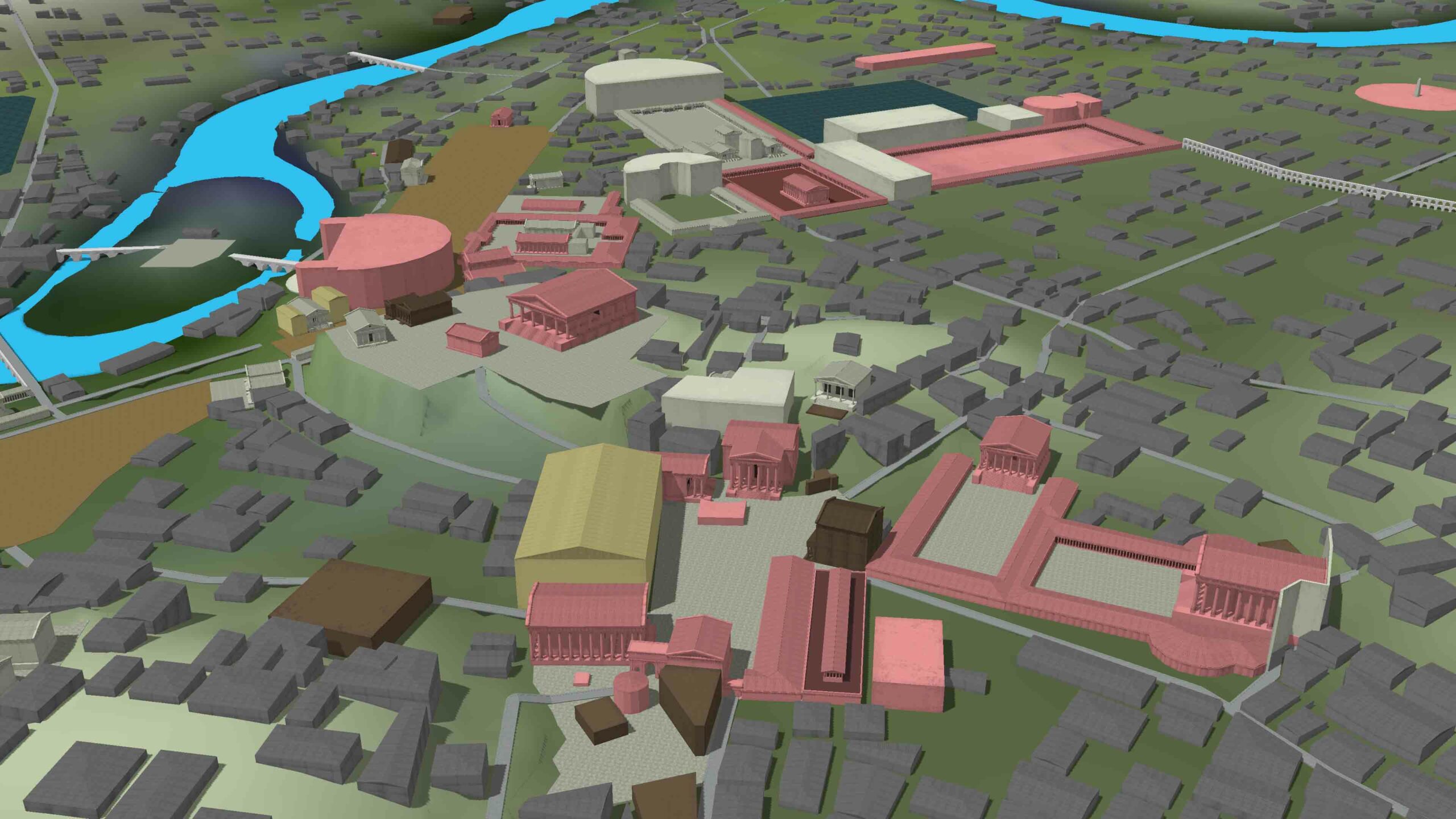

Citizens of the Roman Republic (509–27 B.C.) were occasionally required to pay tributum, a tax that helped finance the state’s activities. As Rome conquered its neighbors, land and the spoils of war were confiscated to replenish the Republic’s coffers. After defeating the Kingdom of Macedonia in 168 B.C., however, the Romans had amassed so much territory that they no longer needed to collect tributum from citizens in Italy. Instead, they could maintain their large army and fuel further expansion solely by taxing conquered provinces in Spain, Gaul, North Africa, and Asia Minor. “Taxes were a price that provincial communities paid because they had been subjugated,” says historian Peter Fibiger Bang of the University of Copenhagen. “In a way, it was a system of oppression. On the other hand, this oppression was maintained by the Roman army, which also kept the peace and offered a kind of protection.”

Under the emperor Augustus (r. 27 B.C.–A.D. 14), taxes on provincial land and agricultural products, as well as customs duties and taxes on inheritance and the sale of slaves, funded free grain for citizens of the city of Rome, infrastructure projects for the growing empire, and the standing army, by far the state’s biggest expenditure. Since the second century B.C., governors and, later, imperial officials had technically overseen taxation in the provinces. From the outset, however, rich tax collectors called publicani partnered to form private companies that bid at public auctions in Rome for the right to collect a province’s taxes for a five-year period. In turn, they offered their property as collateral. “The publicani were notorious,” Bang says. “Whatever surplus they could create was theirs to keep. They made sure they weren’t going to lose money, so they squeezed as much from the provincials as they could.” The Roman historian Tacitus writes that in response to complaints about the “excessive greed” of the publicani, the emperor Nero (r. A.D. 54–68) instituted strict reforms to curb their exploitative activities and decreed that tax laws should be posted publicly for transparency.